BONK has respected the range extremes over the past month.

Edited By: Jibin Mathew George

- Range-bound trading was not accompanied by steady BONK accumulation

- Momentum was bearish at press time and buyers would need to wait for a deeper dip before trying to go long

BONK was unable to embark on a bullish trend. The wider market sentiment was fearful and buyers were weakened in the short-term. In fact, the lack of demand hurts the memecoin’s chances of a breakout on the charts.

While traders still have opportunities to make profits, they will have to be patient. September is likely to be a tricky, volatile month with lots of news events that could have a sudden impact on the asset’s price.

BONK bulls hold on to the local support level from mid-August

BONK’s range was in play and the range lows at $0.0000162 appeared to be the next short-term price target. However, there was a local support level at $0.0000174 as well. On the 12-hour chart, the momentum was bearish based on the RSI.

The OBV also hinted at seller strength with the indicator struggling to embark on a consistent uptrend over the past month. The higher timeframe charts showed that the Fibonacci retracement level at $0.0000188 was a key level.

And yet, market sentiment was fearful and BONK accumulation was not yet underway in earnest. Investors with a lengthy time horizon can be hopeful of a rally in the coming months, but for the next week or two the range-bound price action is expected to persist.

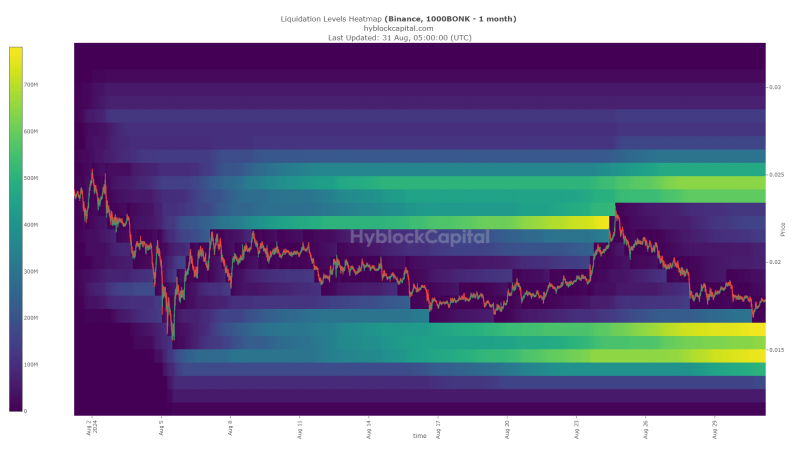

Liquidation heatmap reveals bullish reversal zone

AMBCrypto analyzed the liquidation heatmap data for BONK for the past month. It agreed with the range-bound price action. There were two key liquidity pools at $0.0000146-$0.0000161 and $0.0000237-$0.0000253.

Realistic or not, here’s BONK’s market cap in BTC’s terms

This coincided well with the range extremes. The strong magnetic zone to the south is likely to be swept at least partially. Hence, BONK bulls should be looking for buying opportunities around the $0.000015 region.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion