Hello friends!

Despite the fact that the market is difficult, with no trading volumes and low volatility, we continue to publish personal potential trades.

Today we’re going to talk about a local trade for Bitcoin.

Yesterday, we witnessed Bitcoin’s price drop sharply on small timeframes and then shoot up just as sharply:

As you can see on the 15-minute timeframe, this price movement first took positions away from buyers and then from sellers (look at the volume delta indicator below).

However, BTC did not update the main local lows, below which it would be clear what awaits the price of BTC next.

In turn, buyers failed to break sellers’ stop orders above $26150. Therefore, in our opinion, yesterday’s events are a rehearsal for a real battle.

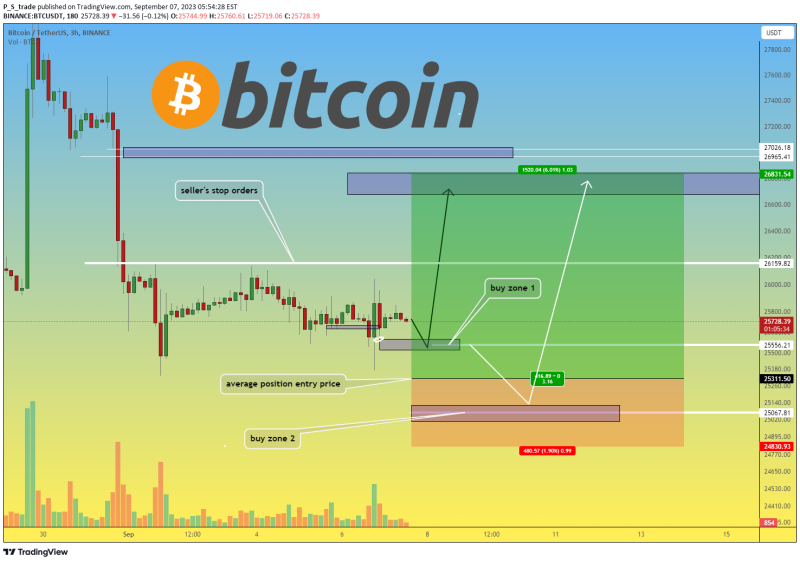

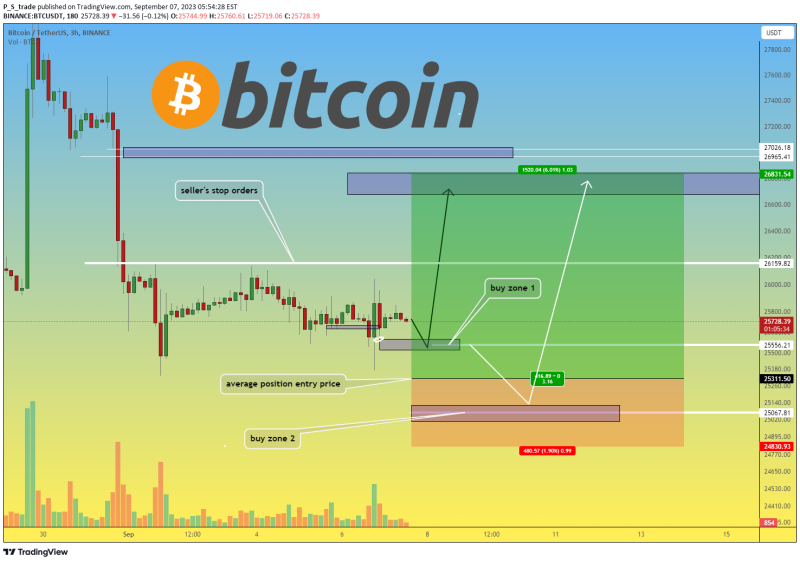

Taking this into account, we are ready to implement the following Bitcoin trade:

#BTCUSDT Long

Enter 1 = 25556

Enter 2 = 25067

Average entry price = 25311

Stop = 24830 (- 1.9%)

TP = 26831 (+6%)

P/L ratio = 3.16

Why are there two entry points on the chart?

We are not sure that sellers will be able to update the local lows from the current price. It is likely that the price of BTC will first rise to 26831 and then try to update the lows. Therefore, we divide the amount of the Bitcoin position into 2 parts:

$5000 at $25556 and $5000 at $25067

we will definitely write about the results of the trade here in the comments! So subscribe to us so you don’t miss any updates! Comment:

do you think the price will reach the target? Trade active:

Comment:

Bitcoin price has reached a second entry point.

Trading volumes have increased and this means that this liquid zone is important. We are waiting for a rebound to understand if there is a chance for a new wave of growth or if Bitcoin will continue its decline. In the event of a likely continuation of the decline, we will close the position before the stop order is triggered.