Bitcoin’s correction on the price charts has stopped. For now.

- BTC has a strong support level near the $40,000-level

- If coin’s price drops below that level, it might sink to $38,000

Bitcoin [BTC] has somewhat managed to stabilize its price after a quick price correction that happened a day ago. However, while considering future prospects, it’s important to take a look at the worst. If the king of cryptos registers another price correction, its value might fall all the way to $38,000.

Bitcoin’s price is stabilizing

Bitcoin caught the attention of investors once it again went past the $40,000-mark recently. However, this uptrend wasn’t to last, with BTC soon recording a correction on the charts. Here, it’s worth noting that after a bout of volatility, the last 24 hours saw the crypto fall by just 1%.

At the time of writing, Bitcoin was trading at $41,814.05 with a market capitalization of over $818 billion. Ali, a popular crypto-analyst, recently pointed out that there are chances of BTC falling under $40,000 towards the $38,000-mark if price correction begins in earnest again.

In case of a deeper correction, #Bitcoin finds solid support between $37,150 and $38,360. This zone is backed by 1.52 million addresses holding 534,000 $BTC.

Also, watch out for two resistance walls that could keep the #BTC uptrend at bay: one at $43,850 and another at $46,400. pic.twitter.com/NGm1XpMOLf

— Ali (@ali_charts) December 11, 2023

To validate the same, AMBCrypto had a closer look at the coin’s on-chain metrics to better understand whether investors should expect BTC to fall to that level before this year ends.

Expectations galore with BTC

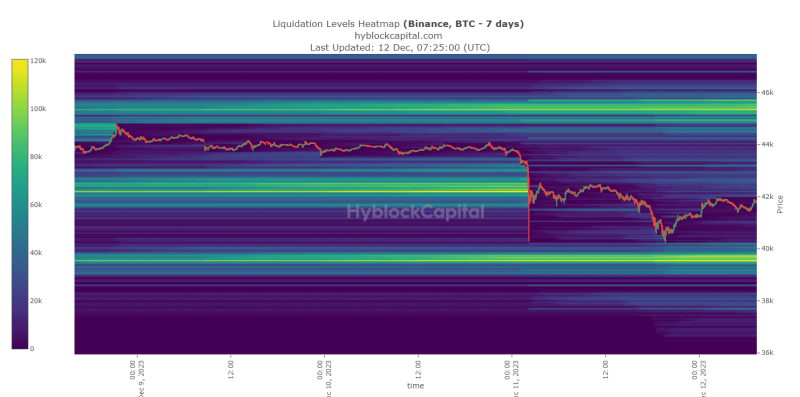

As per our analysis, BTC has built a massive resistance level near the $44,000-level, especially as liquidation levels increased during that period. However, there is also a strong support level at $40,000, a level that is clear from the fluorescent lines towards the bottom of the chart.

AMBCrypto then had a look at BTC’s market sentiment to check the possibility of BTC being unable to rebound from its support level near $40,000. We found out that selling pressure on the coin was high as its exchange reserve was increasing.

As per CryptoQuant, Bitcoin’s aSORP was also red, meaning that more investors have been selling at a profit. In the middle of a bull market, it can indicate a market top.

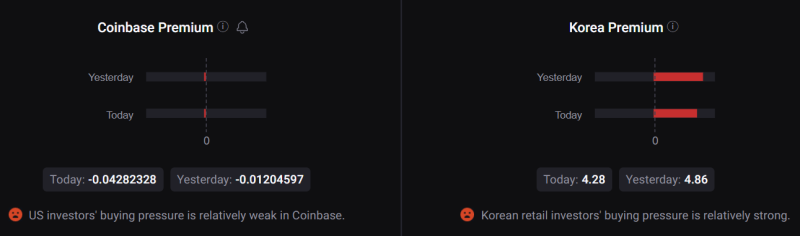

Additionally, both its Coinbase premium and Korea premium were in the red, clearly suggesting that selling sentiment among U.S and Korean investors is relatively high now. Whenever selling pressure rises, it increases the chances of a price drop.

Finally, on the price charts, BTC’s MACD flashed a bearish crossover. On top of that, its Money Flow Index (RSI) also registered a downtick, increasing the chances of a price decline in the days to come.