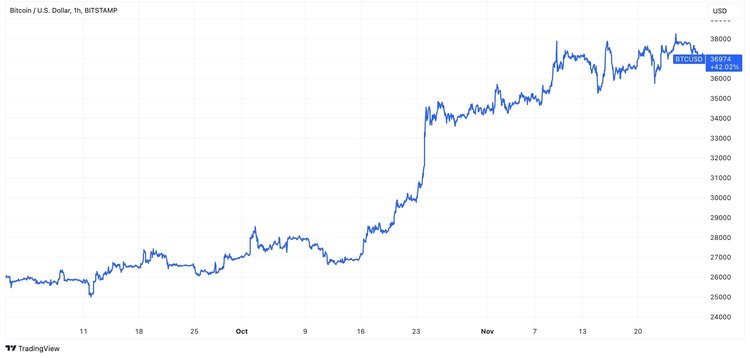

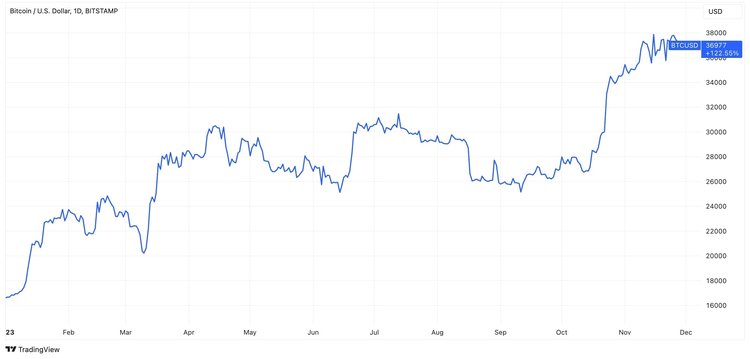

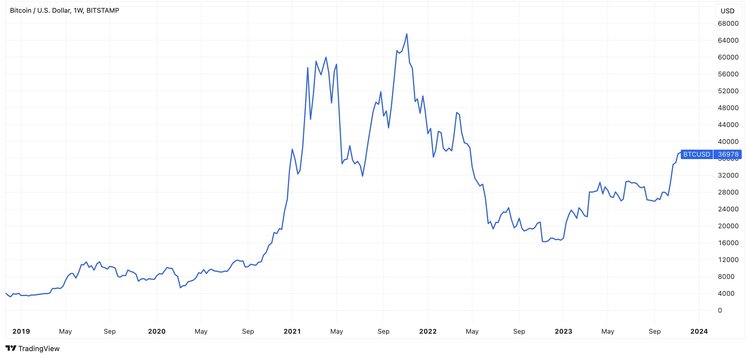

The oldest and the biggest cryptocurrency has marked a remarkable ascent in the past three months. If you had bought 1 BTC on September 1, you would have heard the coin sound in your virtual pocket – Bitcoin has experienced an increase from $26K to $37K. Let’s recall this bright fall and delve into the factors pushing BTC to the top. Take a look at the chart with BTCUSD movements since the beginning of September. Bitcoin successfully surpassed several significant psychological marks during this period – never dipping below $25K and then gradually reaching $30K and $35K. Simultaneously, the percentage gain for the entire 2023 seems mind-boggling – more than a 120% increase. However, these figures still fall short of all-time peaks; nevertheless, the BTC cannot help captivating attention. Hype is here. You know, sometimes, a positive mood is paramount. You might get stuck in a rut, or it can be raining outside the window, but having a reason to smile or believing in the best can make everything feel better. This description parallels what transpired with BTC this fall. Many crypto investors and traders are optimistic that the SEC might approve a Bitcoin ETF, and this optimism acts as a driving force, propelling the price upwards. This optimistic sentiment is so potent that even negative news, such as issues in Binance, fails to significantly impact BTC. Simultaneously, fake news about ETF approval sent BTC soaring, and denials are powerless to halt its ascent. While most Bitcoin movements are linked to news, rumors, and insights about the SEC and BTC ETF, there are a few less noticeable yet crucial factors to consider. One of them is the weakening of the US dollar and the diminishing rate of US bonds. The attractiveness of these assets waned, prompting investors to look for riskier alternatives. BTC and crypto might be seen as such alternatives, especially in a growing market. Bitcoin halving is around the corner. This is one of the very few periodic events in the crypto world, and Bitcoin traditionally exhibits growth after every halving. In this case, buying the crypto in advance seems to be a prudent move. With BTC’s increase exceeding 120% and the year not yet concluded, the question arises – can it go even higher? Some experts are confident that there is significant room for further growth, while others believe we may have already witnessed the peaks. The correct answer lies in your own analysis. The opinions expressed in this article are those of the authors.