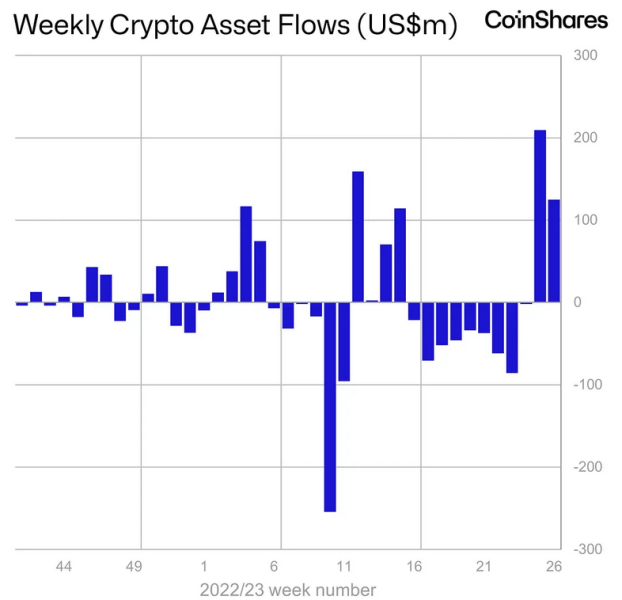

Bitcoin investment products have experienced $310.6 million in inflows over the last two weeks.

Bitcoin (BTC) has been the “primary focus” for institutional investors over the last two weeks, according to CoinShares, as the cryptocurrency continues to hit new highs for 2023.

In a July 3 report from CoinShares’ head of research James Butterfill, the analyst noted that Bitcoin-related products saw $310.6 million of inflows over the last two weeks, representing the vast majority of crypto product inflows.

“Bitcoin remained the primary focus of investors […] with the last 2 weeks inflows representing 98% of all digital asset flows,” said Butterfill.

The last two weeks of inflows are a reversal from the previous nine consecutive weeks of outflows. Short Bitcoin products also experienced a minor outflow of $0.9 million over the last week.

It’s the second time this year that Bitcoin products have accounted for 98% of inflows into cryptocurrency investment products, and it comes amid a surge in Bitcoin’s price and dominance.

Much of this surge has been pinned on BlackRock’s June 15 spot Bitcoin ETF application, followed by similar filings from Fidelity, Invesco, Wisdom Tree and Valkyrie.

Since the filings, the price of Bitcoin has increased 25.2% to $31,131 at the time of writing. Bitcoin’s dominance — which is a measure of its market cap relative to the total market cap of all cryptocurrencies — has risen to 51.46%, according to data.

Bitcoin Fear and Greed Index is 64 — Greed

Current price: $31,158 pic.twitter.com/Tl8vVQp9GA— Bitcoin Fear and Greed Index (@BitcoinFear) July 4, 2023

Meanwhile, Ethereum investment products inflows came in at $2.7 million last week, the second week of inflows reversing a lengthy outflow trend.

Speaking to Cointelegraph on June 26, Fireblocks CEO Michael Shaulov said there had been a “fair amount of interest” from institutional investors in core assets such as Bitcoin and Ether (ETH), but less so in alternate cryptocurrencies.

“The narrative around Ethereum is pretty much the understanding that future ecosystems of tokenization are likely to be [Ethereum Virtual Machine] EVM-based. And if they’re EVM based, then Ethereum is going to play out as utility.”

Shaulov said the narrative around Bitcoin has been less specific but said most investors see the need to hold the cryptocurrency.