- The divergence between Bitcoin’s hash rate and price could signal a potential rally in prices, according to historical data.

- September’s counter-seasonal price trend has already started to show signs of this divergence trend playing out.

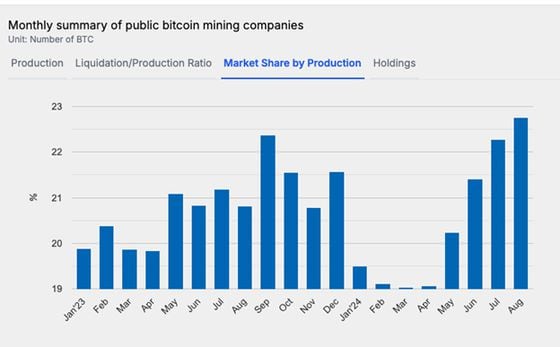

- Publicly traded miners have increased their market share post-halving by raising their computing power and started accumulating bitcoin, potentially reducing market supply and raising a chance of upside to the price.

A divergence between bitcoin (BTC) price and its hashrate or network’s total computing power could potentially point towards a rally in the price of the largest digital asset.

Historically, these divergences have occurred only a few times in the past three years. In some cases, bitcoin prices have reached a local bottom during these events, followed by a rally as the market catches up with the rising hash rate. Bitcoin network’s hashrates rise and fall depending on how many miners have their mining computers online to validate transactions.

Consistent with this pattern, bitcoin has already shown signs of recovery, gaining about $9,000 since the local bottom on Sept. 6, representing a 15% increase in value. This divergence between bitcoin’s (BTC) price and its hash rate started to shape up in July and then persisted into early September, when the computing power of the network reached an all-time high of 693 exahashes per second (EH/s) on a seven-day moving average, while bitcoin’s price was near $54,000.

A significant factor contributing to the recent surge in hash rate is the activity of publicly traded mining companies. Before the halving – where bitcoin rewards get cut in half – the hash rate peaked at 650 EH/s and dropped to 550 EH/s in June, as less efficient miners exited the network due to higher competition. It has now returned to pre-halving levels as publicly traded miners that are well-capitalized, have increased their market share by raising their computing power.

In fact, data from the sixteen public companies show that they have almost reached a 23% market share in production, the highest since at least January 2023, according to the industry journal TheMinerMag. It is likely that publicly traded miners will continue to capture a larger share of the hash rate over time as they compete to stay profitable post-halving.

Counter-seasonal trend

September has historically been dubbed a bearish month for bitcoin, with historical data from Coinglass indicating an average price decline of 4%. However, this year has defied that trend, with bitcoin posting a 7% increase so far. This counter-seasonal trend could be indicating that due to the lower bitcoin price and rising hashrate, the price could be playing catch up with the hash rate, potentially setting up for another rally. Of course, there are other market factors such as interest rate decisions could also catalyze this price change.

Additionally, the next difficulty adjustment, scheduled for Sept. 25 and projected to decrease by 5%, could also indicate that prices may be catching up. Blocks are currently being mined at an average of 10.5 minutes, according to mempool.space. This indicates a potential slowdown in the hash rate as price plays catch up.

Miners accumulating

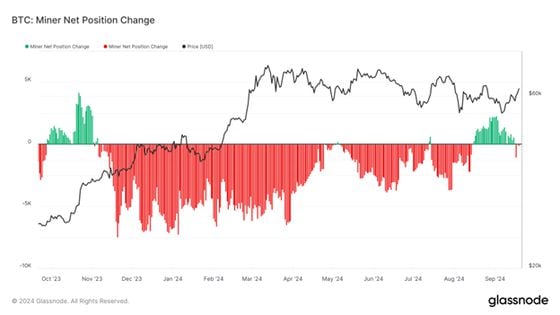

Another factor that could signal a potential rise in price is what miners are doing with their mined bitcoin.

Glassnode data indicates that from November 2023 to August 2024, miners consistently sold bitcoin to fund their operations due to the halving, marking one of the longest periods of sell pressure on record.

However, in the past 30 days, miners began accumulating bitcoin in their wallets, suggesting that the financial strain from the halving is largely over. If miners are distributing less bitcoin, this reduces the supply entering the market, increasing the chance of potentially helping the price.

Edited by Aoyon Ashraf.