Crypto markets are posted on Tuesday as long-dated government bond yields headed sharply lower across the globe following far weaker-than-expected Chinese trade numbers for July. The move also comes one day after payments giant PayPal (PYPL) announced plans to issue a stablecoin in the coming days.

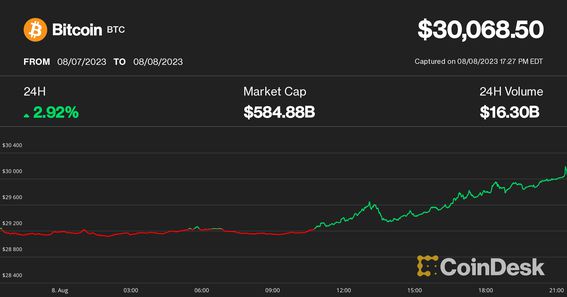

Bitcoin (BTC) rose just shy of 3% over the past 24 hours to $30,068 leading the CoinDesk Market Index (CMI) to a 2.9% advance. It’s bitcoin’s first foray above $30,000 since a very brief move above that level on Aug. 3. Other movers of note Tuesday include solana (SOL), toncoin (TON) and chainlink (LINK), all sporting gains of more 5%.

China overnight reported a 12.4% year-over-year decline in imports in July, more than double the drop forecast by economists. Exports fell 14.5%, worse than estimates for a 12.4% drop. Declines at those levels haven’t been seen since the COVID-19 lockdowns, and the news suggests Beijing may have to take additional steps to stimulate China’s economy.

The U.S. 10-year Treasury yield is lower by 11 basis points to 3.98%. At one point last week, the 10-year was at a 2023 high just shy of 4.20%. Yields on long-dated government bonds across Europe are posting even steeper declines on Tuesday, including in Germany, where the 10-year Bund yield is down 15.4 basis points to 2.445%.

In other economic news, Philadelphia Federal Reserve President Patrick Harker said in a speech that barring “alarming” new data, he’s fine with the central bank not hiking rates any further. He added, though, that the idea of considering rate cuts is a long way off.

Don’t sleep on PayPal’s stablecoin news

Some market watchers remained upbeat about the longer-term growth of crypto markets despite the generally muted response to news Monday that PayPal is introducing its own stablecoin (PYUSD), marking the first time a major financial company is issuing its own stablecoin.

Users will be able to transfer PYUSD between PayPal and supported external digital wallets, use the tokens to pay for goods and services or convert any of PayPal’s supported cryptocurrencies to and from PYUSD.

“PayPal USD (PYUSD), a U.S. dollar stablecoin issued in collaboration with Paxos Trust Co., is a significant development in the digital finance landscape,” Jeff Mei, chief operating officer of crypto exchange BTSE, said in a Telegram message. “Signifying the growing convergence between traditional financial systems and the world of crypto, this news is definitely bullish for the crypto market.

“If the regulators do welcome this with open arms, we might see more U.S. fintech and payment companies proactively exploring digital currencies, and may even make a concerted shift toward new launches,” Mei said, adding successful launches may help instill confidence in the concept of stablecoins, especially following “last year’s setback Terra USD.”

Hedera Hashgraph’s HBAR Leads Gains

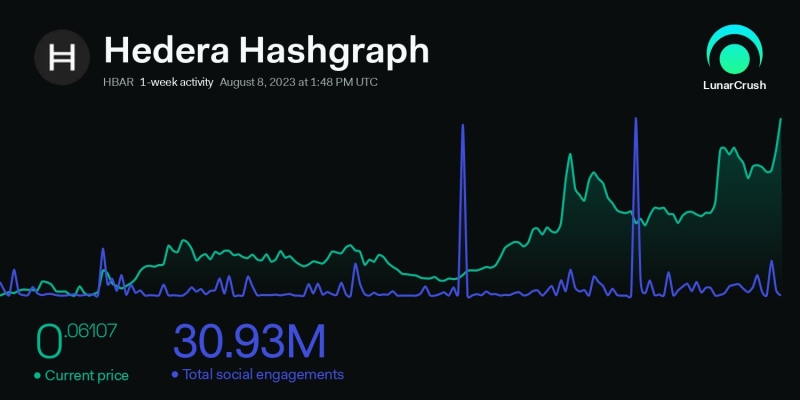

HBAR, the native token of the Hedera Network, which claims to be the only public distributed ledger network suited for the security and stability requirements of big businesses, has seen its price shoot up over 10% over the past 24 hours, outpacing all other cryptocurrency gains on Tuesday.

Hedera’s social activity has soared with 30.68 million engagements over the past week, which is a 240% increase from the previous week, , a social intelligence platform. The social engagement metric measures community participation in social posts, measured by likes, retweets, comments, bookmarks, influential account participation, and more.

The token has gained just under 30% over the last month. “Notice the spikes in social engagement (in blue) happening right before market activity/price movement (in green). Over the past week, there have been three price pushes, all preceded by soaring social engagement,” said LunarCrush.

Hedera also last week that former White-House open source expert Andrew Aitken will be the company’s chief open source officer. Additionally, Hadera’s Governing Council last week voted to approve changes to the staking reward program, adjusting upward the maximum staking reward to 2.5%..

Edited by Stephen Alpher.