10 Years of Decentralizing the Future

May 29-31, 2024 – Austin, TexasThe biggest and most established global event for everything crypto, blockchain and Web3.Register Now

- BTC rose over 7.5% on Wednesday, capping its best performance since March 20.

- Weak U.S. data strengthened the case of a Fed rate cut in September.

- The BOE and ECB are likely to cut rates in June.

Bitcoin (BTC) posted its biggest single-day gain in nearly two months on Wednesday as weak U.S. economic data raised the probability that the Federal Reserve (Fed) will join its advanced nation peers in easing monetary policy with rate cuts over the summer months.

According to data sources TradingView and CoinDesk, the leading cryptocurrency by market value rose over 7.5% to $66,250, the largest percentage rise since March 20. Like other risk assets, BTC is sensitive to expected changes in the monetary policy stance of major central banks and rallies when the cost of borrowing fiat money is forecast to decline.

Data released by the U.S. Labor Department Wednesday showed the consumer price index (CPI) increased less than consensus estimates in April, signaling a renewed downward shift in the cost of living in the world’s largest economy. The headline CPI rose 0.3% last month after advancing 0.4% in March and February. The core CPI, which excludes food and energy prices, rose 0.3% in April after advancing 0.4% in March.

Other data showed that headline retail sales growth stalled in April, with the sales in the “control group” category, which feeds into the GDP calculation, declining 0.3% month-on-month.

As such, rate-cut expectations shifted significantly. Fed funds futures show traders expect the Fed to deliver the first 25 basis point rate cut in September. (This year’s summer is set to start on June 20 and end on September 22). The Fed recently signaled that it will reduce the pace of quantitative tightening, also a liquidity tightening tool, from June.

It’s not just the Fed. Markets expect the Bank of England (BOE) and the European Central Bank (ECB) to cut rates in June. The Swiss National Bank (SNB) and Sweden’s Riksbank have already reduced their benchmark borrowing costs.

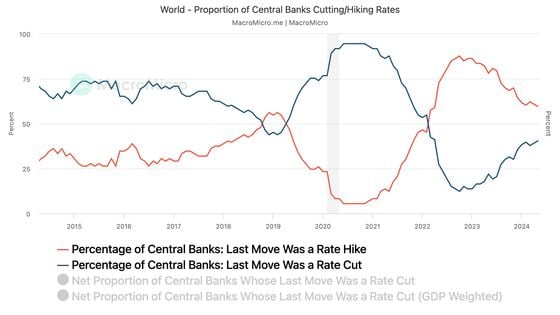

Central banks worldwide are pivoting toward renewed monetary or liquidity easing, which is a positive sign for risk assets, including cryptocurrencies, as evident from the chart below from the data tracking website MacroMicro.

The percentage of global central banks whose last move was a rate hike is falling fast, while the percentage of banks with rate cuts as the last move is rising.

In other words, the net percentage of central bank cutting rates is rising.

“The higher the proportion goes, the more central banks are cutting rates, which could help improve market liquidity. The lower the proportion, the less liquidity there is in the market,” MacroMicro said in the explainer.

Prospects for liquidity easing over Summer should support equities, giving investors adequate confidence “to remain further out on the risk curve,” according to broking firm Pepperstone.

Edited by Parikshit Mishra.