- Bitcoin is grappling with heavy resistance at the $28,000 level, where two key moving averages have capped rallies this week.

- Crypto markets rebounded after blowout U.S. employment data, led by AVAX and SOL.

- BTC eschewed its correlation with long-duration bonds and equities, bringing back its “digital gold” narrative, one analyst said.

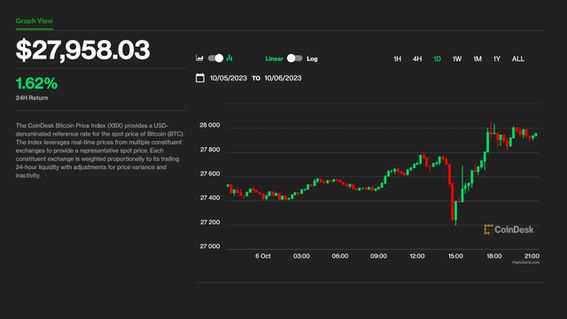

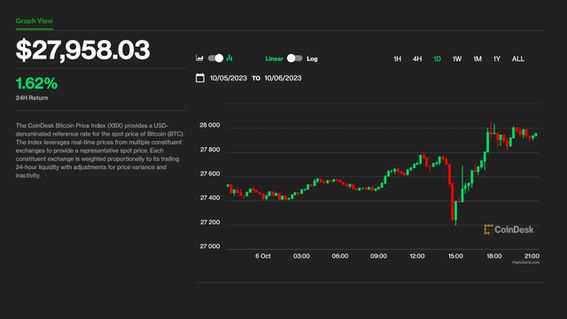

Bitcoin (BTC) is once again flirting with key resistance at $28,000 on Friday as crypto and traditional markets rebounded from early losses caused by stronger-than-expected U.S. employment data.

The largest cryptocurrency by market capitalization slid nearly 2% to below $27,300 on news that the U.S. economy added 336,000 jobs in September, almost doubling economist expectations. The losses were short-lived, however, with bitcoin quickly rebounding to just above $28,000.

The price stood just below that level at press time, up 1.5% over the past 24 hours and slightly underperforming the broader crypto market proxy CoinDesk Market Index’s (CMI) 1.6% advance.

Alongside, U.S. stocks recovered from sharp early losses, with the Nasdaq sporting a 1.75% advance shortly before the close of Friday trade.

Ether (ETH) halted its losing streak against BTC, outperforming the market and bouncing nearly 2%. The second largest crypto asset was changing hands at $1,650 during afternoon hours.

Layer 1 network Avalanche’s AVAX and Solana’s SOL led the market rebound among major altcoins, gaining 6% and 3.8%, respectively.

What’s next for bitcoin’s price?

Both the 200-day moving average and the 200-week moving average lie at around $28,000, acting as heavy resistance for any price increase, Rachel Lin, CEO of derivatives decentralized exchange SynFutures, said in an email.

“Therefore, bitcoin is witnessing strong selling every time it reaches that zone,” Lin said. “A sustained break above $28,100 would be a positive sign and could lead Bitcoin to $30,000.”

Lucas Outumuro, head of research at IntoTheBlock, noted Friday in a market report that bitcoin has been acting differently during the recent bond sell-off compared to last year.

“Many of the catalysts that brought BTC down in 2022 are no longer doing so,” Outumuro said.

He explained that when the Federal Reserve jacked up interest rates last year, the value of long-duration bonds tanked, putting pressure on risk assets like bitcoin. As the pace of rate hikes slowed and speculation began about a Fed pivot earlier this year, long-duration bonds and BTC rallied.

Now, the relationship between the two assets has flipped, with bitcoin heading higher even as long-term bond price craters.

“The market appears to be reevaluating bitcoin’s value proposition amid global uncertainty,” Outumuro said.

“Bitcoin’s recent price stability during the bond and equity sell-off highlights its growing status as an independent asset class,” Michael Silberberg, head of investor relations at crypto hedge fund AltTab Capital, told CoinDesk in an email. “This decoupling marks a further evolution towards bitcoin’s ‘digital gold’ narrative.”

“If it persists in trading in a tight range while stocks and bonds sell-off, it will solidify this narrative and likely attract more institutional inflows seeking uncorrelated assets,” Silberberg added. “We expect this new maturity could mark the start of a long-term bull trend over the next 4-6 months.”

Edited by Stephen Alpher.