BTC price strength fails to sustain $29,000 support as the week begins with fresh weakness for Bitcoin.

Bitcoin (BTC) fell below $28,700 after the Aug. 7 Wall Street open as “endless spot selling” drove BTC price action lower.

Bitcoin traders brace for losses as $29,000 support breaks

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD returning nearer to its August lows after a shaky weekly close.

The start of United States trading offered no signs of relief for bulls after a weekend of sideways behavior, with traders and analysts already predicting a downward outcome once the impasse broke.

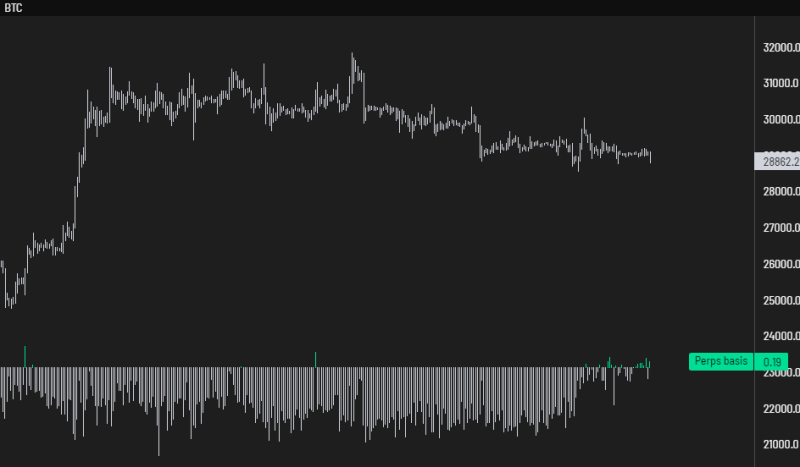

Commenting on the situation, popular trader Daan Crypto Trades noted that derivatives trading at a premium over spot placed bulls in an even less advantageous position.

“There being a Perpetual pair premium vs Spot is really never a good sign. Combined with the endless spot selling + choppy price action is not what you want to see. Be careful out there,” he told X (formerly known as Twitter) followers.

Trading suite DecenTrader warned that one of its proprietary trading tools had flipped bearish “across most timeframes,” while earlier, popular trader Crypto Tony said that $29,000 was already weakening as support.

“Losing $29k support. The slow bleed continues as people refuse to see the weakness in the markets,” trading team IncomeSharks added.

Looks likely to retest the green zone below and possible break lower from there.

We had the 2 consecutive daily closes below support signaling further downside as likely. pic.twitter.com/TzTtMTvLB2

— Nebraskangooner (@Nebraskangooner) August 7, 2023

Bets on a drop into the Aug. 10 U.S. Consumer Price Index print were already on the table — something that would constitute, should it play out, classic BTC price action.

Data from monitoring resource CoinGlass put total BTC long liquidations at over $10.5 million on the day. Cross-crypto long liquidations stood at $60 million.

Can BTC price avoid a 2023 double top?

Zooming out to weekly timeframes, meanwhile, popular trader and analyst Rekt Capital revealed an interesting showdown in the making for BTC/USD.

Weekly candles were in the process of completing a double top formation, he noted in a YouTube update on the day, with confirmation due within the next month.

To print the classic M-shaped pattern, however, Bitcoin would need to revisit the area around $26,000 — something that would require a violation of multiple key moving averages.

These included the 200-week simple moving average (SMA), as well as the 21-week and 50-week exponential moving averages (EMAs).

“The thing about this structure overall and generally this region acting as a confluence support region is because we also have two bull market bullish momentum exponential moving averages developing here,” he said about the area between $26,000 and current spot price.

That support cluster, Rekt Capital added, could end up being what “really gets in the way” of a double top, and instead allows Bitcoin to print a weekly higher low and continue upward.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.