10 Years of Decentralizing the Future

May 29-31, 2024 – Austin, TexasThe biggest and most established global hub for everything crypto, blockchain and Web3.Register Now

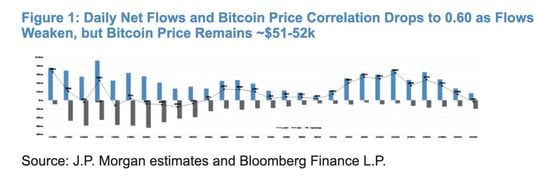

The price of bitcoin (BTC) has not been moving as closely in relation to flows in and out of the spot ETFs as it previously did, according to JPMorgan.

On Wednesday, the correlation between the two asset classes dropped to 0.60, said analyst Ken Worthington in a note Thursday morning to the bank’s clients. That’s down from 0.78 on Feb 7., said Worthington, and from as high as 0.84 on Jan. 31.

Worthington said a number above 0.70 is considered “highly correlated,” and just below would be “moderately correlated.”

Inflows accelerated last week when investors poured a record $2.4 billion into the funds, the largest amount in their short history. The inflows continue to be dominated by BlackRock’s IBIT and Fidelity’s FBTC, which to this point have garnered nearly $11 billion in AUM.

For now, it appears that flows are following price, with bitcoin’s sharp gains in early February leading to a jump in money going into the ETFs. The leveling in price of the last few sessions has may have been the trigger for softer inflows into the funds.

Edited by Stephen Alpher.