Bitcoin Cash hit a 2023 price peak of $329 on June 30 before retracting 48%. But despite experiencing intense volatility in H2 2023, Bitcoin Cash long-term investors continue to HODL.

Long-term Investors Now Make Up 96% of BCH Holders

BCH reclaimed the H2 2023 $228 peak on August 29, less than two weeks after dropping toward $164. Amid intense volatility in the broader crypto industry, BCH has held the vital $180 support level since then.

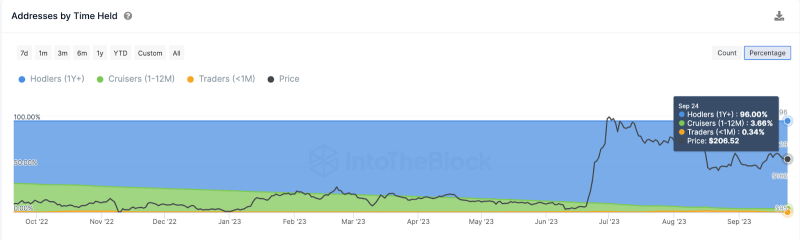

On-chain data reveals that resilience shown by long-term investors has been vital to BCH’s strong price performance in recent weeks. As depicted below, only 22.5 million addresses had held their balances for up to 1 year when the BCH price hit the 2023 peak of $329 on June 30.

But, despite the price correction that has followed, the number of long-term holder wallets has now hit 23.96 million. This brings the Long-term holder dominance to 96%.

Bitcoin Cash (BCH) Addresses by Time Held. Source: IntoTheBlock

In crypto terms, BCH wallets that have held their tokens for 1 year or more or less are called “Long-term Holders.” Generally, a higher number of long-term holders can contribute to price stability.

The chart above clearly illustrates that rather than close their positions amid price fluctuation, a significant number of investors on the BCH network have become long-term holders over the past three months.

This is a tell-tale sign that the recent BCH price recovery is being driven by organic network growth rather than speculative trading activity.

A 96% long-term holder dominance suggests that BCH could experience a low turnover of coins going forward. Since they are less likely to engage in frequent sell-offs, this could mitigate the volatility and power bullish price action in the coming weeks.

Read More: Best Upcoming Airdrops in 2023

Long-term Holders Dominance Could Spur Whale Accumulation

As Bitcoin Cash long-term investors double down on their positions, whale investors appear to grow in confidence.

Indicatively, crypto whales with balances of 100,000 to 10 million BCH held a total of 3.74 million BCH as of September 18. But the chart below illustrates that as of September 26, that figure has increased to 3.86 million BCH.

Notably, the newly acquired 120,000 BCH brings the whales’ balances to levels last seen in July 2023.

Bitcoin Cash (BCH) Whale Wallet Balances. Source: Santiment

Currently valued at $213, the 120,000 BCH recently acquired by the Bitcoin Cash whales are worth approximately $25.6 million. Historical trends show that due to their substantial holdings, the buying activity of this whale cluster has often moved BCH prices significantly.

Hence, if the long-term investors keep HOLDing, BCH price holders could experience more upside in the coming weeks.

BCH Price Prediction: Steady Climb Toward $300

Bitcoin Cash price action has been underwhelming in H2 2023 so far. Nevertheless, the growth in Long-term holder addresses suggests that the ecosystem will likely maintain a steady user base and network demand to propel BCH toward $300 long term.

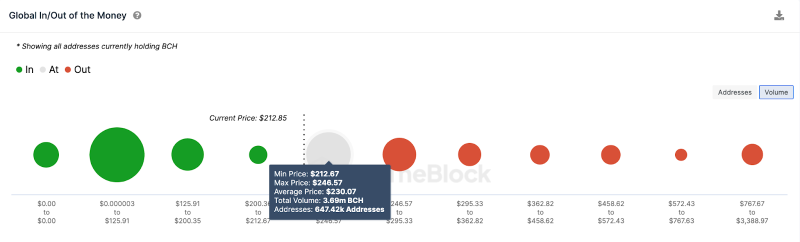

The Global In/Out of Money Around Price (GIOM) data, which depicts the purchase price distribution of current Bitcoin holders, also validates a bullish narrative.

It shows that if the BCH price scales the initial resistance at $230, the bulls could ride the wave toward $300.

As shown below, 647,420 addresses had bought 3.69 million BCH at an average price of $230. If they book early profits, they could pose a major obstacle.

But if the long-term investors keep stockpiling their holdings, the Bitcoin Cash price could reach $300 eventually.

Bitcoin Cash (BCH) GIOM data. Source: IntoTheBlock

Conversely, the bears could seize control if BCH’s price swings below $200. However, the chart above shows that 175,070 addresses have bought 393,940 BCH at the maximum price of $200.35.

They will likely avert a bearish downswing, especially given the current buy pressure among the whales.