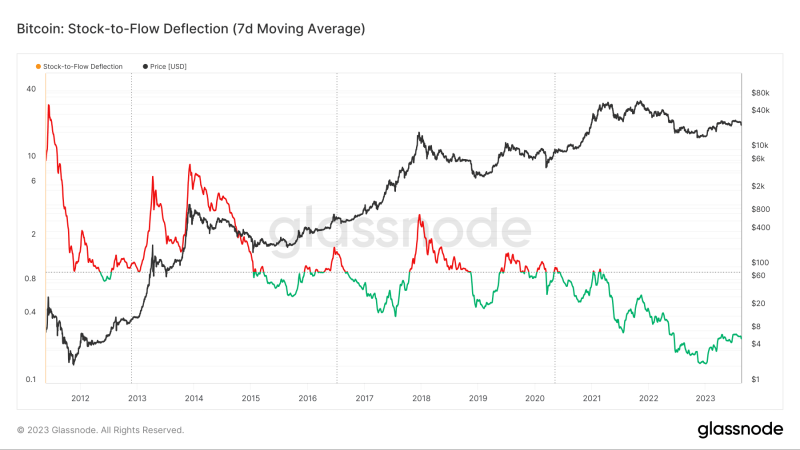

Bitcoin’s value was worth only about 0.2 of what it should ideally be as per the stock-to-flow model, suggesting room for exponential growth.

- As per stock-to-flow deflection, Bitcoin was undervalued in relation to its scarcity.

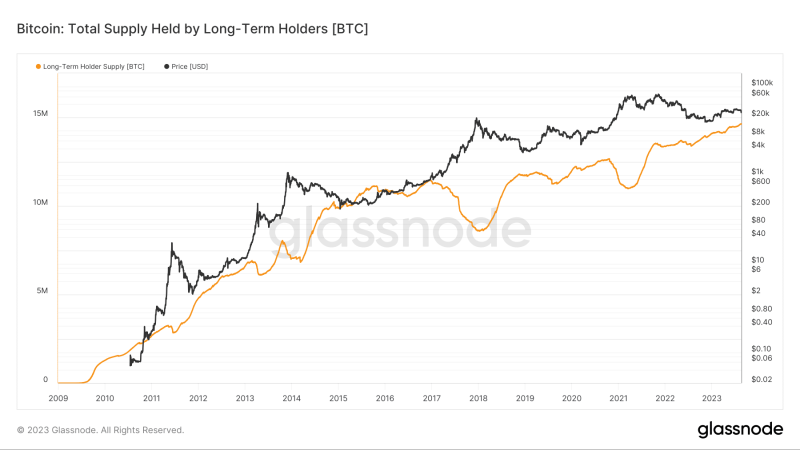

- Long-term holders had access to 75% of Bitcoin’s circulating supply.

The impact of Bitcoin’s [BTC] scarcity on its long-term value has been one of the most widely discussed and analyzed topics within the crypto community. Over the years, experts have developed several models that provide insights into the relation between the two and help investors make informed decisions.

Is your portfolio green? Check out the BTC Profit Calculator

According to a recent post by on-chain analytics firm Glassnode, BTC’s stock-to-flow (S/F) deflection dipped to a 1-month low, suggesting more room for bull cycles in the near future.

Bitcoin’s scarcity to drive its value

In layman terms, the S/F deflection determines whether an asset is overvalued or undervalued in relation to its scarcity. In the current situation, the deflection was less than 1 and as indicated above, deeper in the green undervalued territory.

The S/F deflection is derived by dividing Bitcoin’s price by one of its most popular models, the S/F ratio. Created by anonymous analyst PlanB, the S/F ratio compares the current stock of Bitcoin to the number of new Bitcoins mined each year.

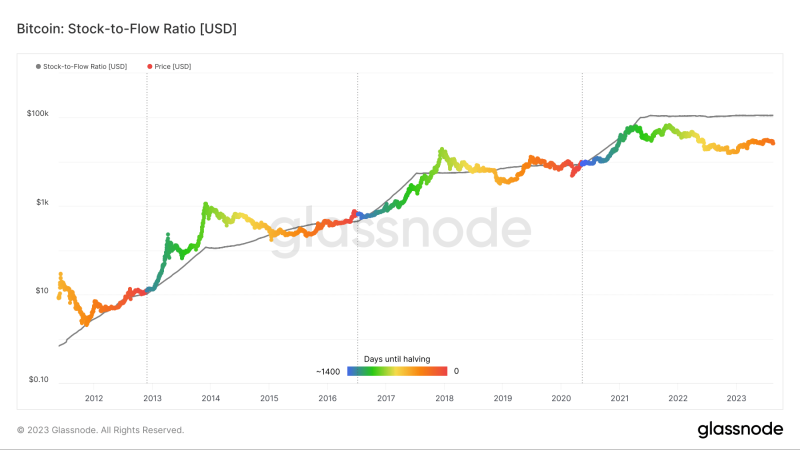

The narrative which underpins this model is that the value of an asset is directly proportional to its scarcity. The higher the ratio, the scarcer the asset becomes, and in turn drives the price.

The model states that the halving events that occur roughly every four years — when the rate of new coins mined is halved— directly affect the price of Bitcoin. Data from Glassnode further proved this. Note how BTC’s price remained subdued in the days leading to the halving. However, on completion, it exploded to new highs.

At the time of writing, BTC was worth only about 0.2 of what it should ideally be as per the S/F model. With the next halving event scheduled for April 2024, there was a chance that BTC would reach its full potential.

How much are 1,10,100 BTCs worth today?

Diamond hands stocking up

The halving-induced bullish expectations spurred long-term Bitcoin holders (LTH) to stock up for the big day. At the time of writing, seasoned investors of the king coin accounted for 75% of all tokens in circulation.

BTC crawled back above the $26,000-mark on 19 August, as the stormy week drew to a close. It exchanged hands at $26,108 at the time of writing, per CoinMarketCap.