It’s going to be a tricky few days for the world’s largest cryptocurrency.

Edited By: Jibin Mathew George

- Critical buy zones for Bitcoin are worth looking at right now

- Bitcoin whales have accumulated 358,000 BTC in July, marking an “unprecedented” transfer of wealth

Bitcoin (BTC) has experienced considerable price fluctuations recently, dropping from around $67,000 to below $65,000 within just 24 hours. This volatility has caught the attention of traders and analysts alike.

In fact, Zen, a popular crypto trader and analyst, noted on X that Bitcoin’s decline mirrored movements in the stock market. He claimed,

“$BTC followed stock market and dumped. Nearest zone of interest 64.5-65k I mentioned before was skipped in one 1H candle – that is why I wrote that it is not good for blind limit orders and requires monitoring at lower timeframes.”

He emphasized the need for caution and close monitoring of price movements to avoid premature buy orders.

Zen further identified critical price zones, stating that the first solid buy zone is around $61.4K to $61.8K, with a lower zone potentially covering the CME gap around $58.5K to $60.5K.

Accumulation by Bitcoin whales

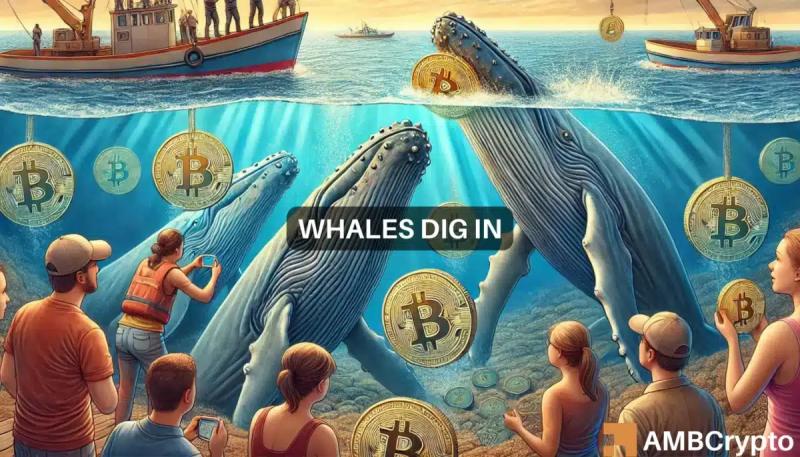

Additionally, on-chain analytics platform CryptoQuant also observed a notable trend of Bitcoin accumulation by large-volume investors, also known as whales. CEO Ki-Young Ju highlighted this in a recent post, describing the flow of coins to these investors as “unprecedented.”

He stated that over the past month, 358,000 BTC has been moved to permanent holder addresses. July alone saw global spot ETF inflows of 53,000 BTC.

Despite not all BTC being in custody wallets, the accumulation phase is evident though, with a substantial transfer of wealth within the crypto market.

Bitcoin was trading at $64,222 at press time, with a 24-hour trading volume of $37,443,835,918. This underlined a 3.35% decline over the aforementioned period.

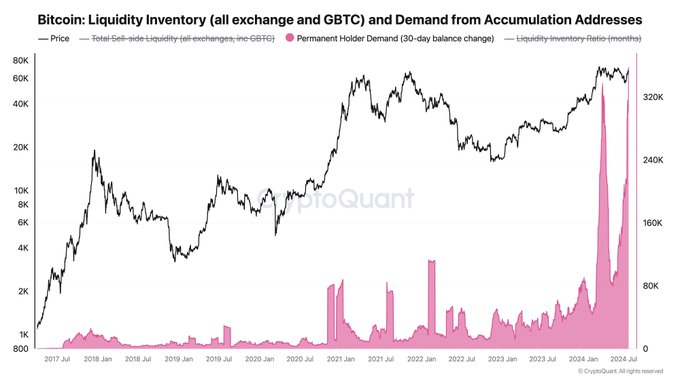

Moreover, the number of active Bitcoin addresses has shown some variability too, ranging from approximately 500K to 1.2M.

At the time of writing, for instance, active addresses numbered 699K, with a transaction volume of 9266 BTC – Marking a decline from previous peaks seen in late February and early June.

Additionally, the Total Value Locked (TVL) in Bitcoin stood at $701.92 million, reflecting ongoing engagement and investment in the cryptocurrency market.

The dynamics of active addresses and transaction volumes provide valuable insights into market activity and investor behavior.

Impact of potential political developments

The upcoming Bitcoin 2024 conference has generated excitement, particularly due to the involvement of 2024 presidential candidate Donald Trump.

Trump has been vocal about his support for Bitcoin, proposing the addition of BTC as a dollar reserve. This ambitious plan aims to establish Bitcoin as digital gold. The potential influence of Trump’s presidency on Bitcoin’s price is a topic of considerable interest among crypto enthusiasts.