Throughout September, the Bitcoin price action has been largely confined to a narrow trading range, demonstrating a period of consolidation. During this time, a descending trendline consistently provided resistance, fueling expectations for an extended corrective phase among traders. However, the recent market surge—partly catalyzed by rising concerns of a U.S. government shutdown—saw BTC price attempting another breakout from this overhead barrier, igniting hopes for a renewed bullish phase.

Also Read: Top 3 Cryptocurrency with Bullish Pattern to Buy in October 2023

Will the Current Recovery Surpass $28000?

- The BTC price above the daily EMAs(20, 50, and 100) could offer additional.

- A bullish breakout from the resistance trendline could surge the coin price by 4%

- The intraday trading volume in Bitcoin is $6.2 Billion, indicating a 6% gain.

Source-Tradingview

Over the last six weeks, the Bitcoin price has encountered resistance from this overhead trendline on three separate occasions, illustrating that traders have been capitalizing on bullish spikes to sell. Today’s trading was no different; despite an intraday gain of 0.7%, the price met increased selling pressure at around the $27,200 mark.

This resulted in a long-wicked candlestick, hinting at the possibility of an imminent bearish reversal. Should the price dip below the low of $26,671 set on September 29, a further decline toward the $25,000 level would become increasingly likely.

However, the prevailing bullish sentiment suggests another potential outcome. If the daily candle manages to close above this key resistance level, we could see the price make a swift 4% recovery to meet the next level of resistance at $28,200, aligned with the descending trendline from previous highs.

A definitive breakout above this point could serve as a strong indicator of a more durable recovery, potentially propelling the BTC price past the significant psychological milestone of $30,000.

1 BTC to USD = $28004.902 3.5% (24h) Buy / Sell

Buy Crypto on an easy to use platform

Invest in leading cryptocurrencies such as Bitcoin, Ethereum, Cardano and more…

BTC

USD

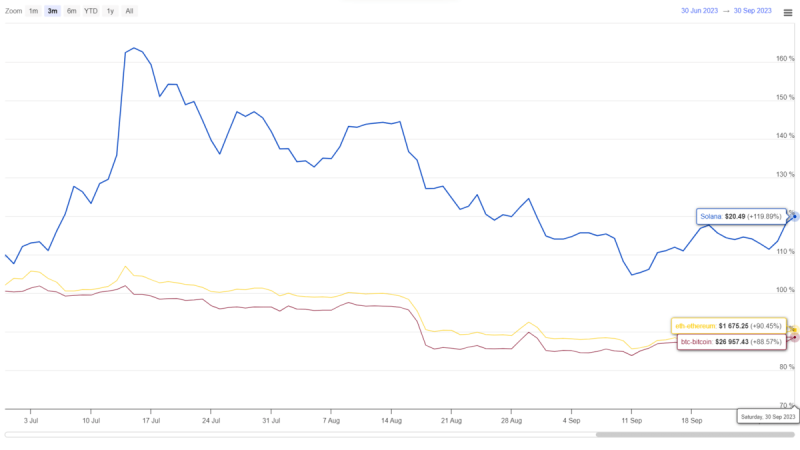

BTC vs ETH Performance

Source: Coingape| Bitcoin Vs Ethereum Price

Coming to the past month’s price behavior in the two leading cryptocurrencies Bitcoin and Ethereum, both have showcased the mid-term trend sideways. However, the Ethereum price has outperformed BTC in last week’s recovery, indicating it is a better asset to ride the current rally.

- Exponential Moving Average: The buyers’ reattempting to reclaim the 200-day EMA slope would offer an additional edge to buyers.

- Average Directional Index: An uptick in the daily ADX slope reflects the buyers have enough potential to extend further recovery.