The devnet glitch added another chapter to Solana’s ill-famed network disruptions.

Edited By: Jibin Mathew George

- The devnet remained offline for nearly a day.

- SOL dropped 1.63% in the 24-hour period with sentiment still remaining negative.

Solana’s devnet has successfully restarted and resumed normal operations, according to the latest update from the Solana Foundation.

The development environment went down in the wee hours of 19 April. Solana developers fixed the issue and the devnet was scheduled to restart at 6 PM UTC. However, an error encountered during the restart extended the downtime. The devnet finally went live at 6 AM UTC on 20 April.

AMBCrypto verified the announcement with the help of Solana Explorer. Indeed, transactions can now be seen getting confirmed on the devnet.

Solana gets disrupted again

Note that the issue didn’t impact operations on the Solana mainnet or even the testnet. That being said, it added another chapter to Solana’s ill-famed network disruptions. Especially since Solana’s mainnet went down for nearly five hours in early February.

Additionally, the network has been grappling with congestion challenges lately due to high volumes of memecoin trading. Rex St.John, senior developer at Solana-focused devshop Anza, announced version v1.18 meant to address these issues. It is now already on the devnet, and would be eventually rolled out on the mainnet.

Sentiment for SOL remains bearish

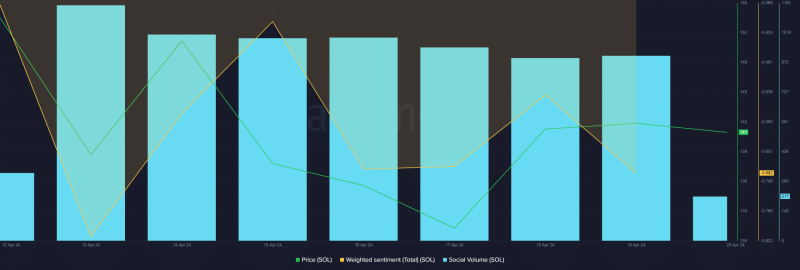

Meanwhile, at the time of writing, SOL was down by 1.8% over the last 24 hours, according to CoinMarketCap, FUD over persistent network glitches could have contributed to the same, especially since Bitcoin’s halving has permeated much optimism across the market.

The altcoin’s social volume i.e, amount of mentions on top crypto-focused social media channels rose marginally on 19 April too, as per AMBCrypto’s analysis of Santiment data. That being said, most of the commentary was negative, with the same evidenced by the negative weighted sentiment indicator.

Read SOL’s Price Prediction 2024-25

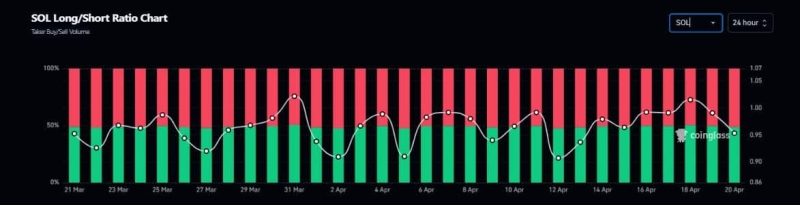

The FUD also hit SOL’s derivatives market as long exposures towards the coin drastically dropped in comparison to short exposures. This implies that traders are now expecting prices to remain subdued or drop further in the short term.