The increase in DOGE’s retail balance is an indication that holders were looking to the meme for a rally.

- Retail DOGE holders have been buying more of the coin.

- The price-DAA showed that it could be a good entry before another rally.

Dogecoin [DOGE] shrimps have been increasing the amount they own, according to AMBCrypto’s analysis of Santiment’s data. Shrimps are crypto investors who represent the retail group.

In Dogecoin’s case, this cohort is the group that owns between 0.01 and 100 coins.

Though this cohort forms a small number of the total Dogecoin supply, the balance of addresses metric showed that the count has been increasing.

DOGE to shine one more time?

Most times, retail investors find it hard to make significant gains in the market. This is one of the reasons why these small investors run to meme coins, as the prices may explode at any point.

So, the increase in the retail balance is an indication that holders were looking to DOGE for a rally.

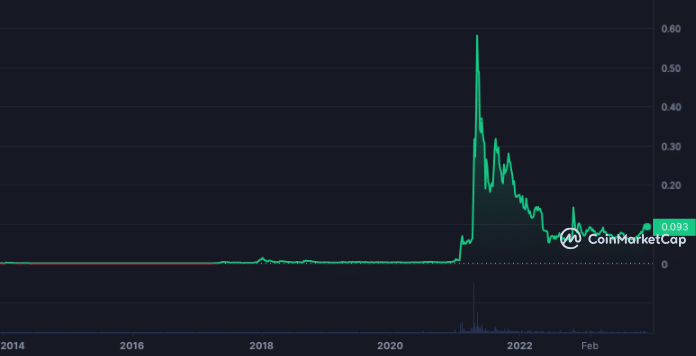

In the last 30 days, Dogecoin’s price has increased by 19.35%. However, the sentiment displayed by this retail cohort signals hopes that DOGE may be able to replicate the form it had around the 2020-2021 cycle.

On an all-time basis, DOGE’s performance is a 16,564% increase, most of which came around the aforementioned period.

For Dogecoin to repeat such performance, there has to be a lot of demand for the cryptocurrency. However, that has not been the case.

One of the reasons is because of the emergence of other memes with immense potential. Examples include PEPE, FLOKI, and Solana-themed BONK.

So, market participants, instead of focusing on DOGE, are rotating money into other meme coins. But that is not to say that Dogecoin’s shining moment is long gone.

To assess the coin’s potential, AMBCrypto decided to check out its price-DAA divergence.

It’s time to pull the buy trigger

The price-DAA is a short form of price-Daily Active Addresses divergence. This metric shows the relationship between an asset’s price action and the active addresses. Investors can also employ it in identifying buy or sell signals.

At press time, Dogecoin’s price-DAA divergence was 33.19%.

The ratio here implies that the DAA has decreased while the price has grown. Historically, this is a signal to buy. But the positive outcome is usually not immediate.

So, those who plan to use this strategy may need to focus on the long-term potential.

From the technical outlook, Dogecoin showed a long-term bullish signal because of the Exponential Moving Average (EMA). At press time, the 50-day EMA (blue) had crossed over the 200-day EMA (yellow).

Is your portfolio green? Check out the DOGE Profit Calculator

This is confirmation that those who HODL DOGE have the potential to be profitable. However, that would not occur without pullbacks.

For instance, the Awesome Oscillator (AO) reading had decreased to 0.0038. The decreasing reading is a sign of increasing downward momentum. So, investors should expect a decline from $0.09 before Dogecoin considers a leg up.