After several weeks of price rally, RUNE has begun to lose momentum, with investors “dumping” their holdings to book gains.

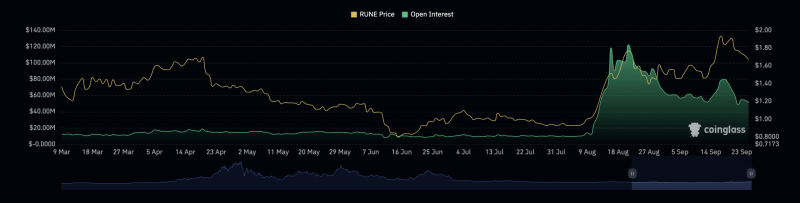

- RUNE shed August gains as profit-taking activity intensified.

- Open Interest has fallen by over 35% in the last seven days.

After several weeks of price rally and upward divergence from the rest of the market, THORChain [RUNE] has begun to fall, becoming the asset with the most significant drop in the last week, data from CoinMarketCap showed.

How much are 1,10,100 RUNEs worth today?

In August, RUNE outperformed the rest of the cryptocurrency market, rallying by 66%.

This was mainly due to two factors: first, RUNE has a low positive correlation with Bitcoin [BTC], whose price fell by 10% during the same period, and second, THORChain, the decentralized liquidity network on which RUNE is the native token, implemented a series of protocol updates.

However, as profit-taking activity gains traction, RUNE’s price has fallen by 11% in the last seven days.

Natural correction after its recent gains

An indication of profit-taking activity amongst RUNE investors was its Moving Average Convergence Divergence (MACD) observed on a daily chart. The indicator initiated a downward crossover of the trend line by the MACD line on 22 September, confirming the commencement of a new bear cycle.

This is a bearish signal because a downward crossover of the trend line indicates that momentum is shifting to the downside.

Moreover, RUNE’s distribution has exceeded its accumulation, with its key momentum indicators pointing south, suggesting that the downtrend is likely to continue.

Although still positioned above their respective center lines, the token’s Relative Strength Index (RSI) and Money Flow Index (MFI) truncated their uptrends when the price started to fall. Should sentiment become increasingly bearish, these indicators might fall below their center lines and head toward oversold zones.

Further, the token’s Chaikin Money Flow (CMF) returned a negative value of -0.01 as of this writing. A CMF value below the zero line is a sign of weakness in the market, as it signals increased liquidity exit from an asset’s spot market.

Realistic or not, here’s RUNE’s market cap in BTC terms

Maybe now is not the time

Despite August’s price rally, RUNE’s open interest witnessed a steady decline. Typically, when an asset’s price grows while its open interest in the futures market declines, it suggests that a relatively small number of buyers is driving the price rally and that there is not a lot of new money flowing into the asset.

At $50.78 million at press time, RUNE’s open interest has fallen by 36% in the last week, data from Coinglass showed. With a downward price correction underway, participants in the token’s futures markets may no longer be incentivized to enter trade positions for the time being.