The stablecoin sector has been met with considerable skepticism from both regulators and the broader community. In particular, USDT, the most dominant player in the market, frequently incites controversy, as its underlying financial backing is often called into question by the community.

Paolo Ardoino Set to Take Charge

According to Bloomberg, Ardoino plans to release real-time reserves data of Tether in 2024. Ardoino, already considered the face of the company during his tenure as CTO, will take over responsibility as CEO from December 2023.

Bloomberg asserts that Tether lacks transparency in multiple aspects, not only in relation to its reserves. This lack of openness also extends to its public offices, the independence of its board of directors, and its overall structure.

Hence, the publication of reserve data will do much to boost transparency.

Particularly, the community’s concerns regarding Tether’s reserves increased after the Commodity Futures Trading Commission (CFTC) ordered it to pay a $41 million fine in October 2021. The fine was due to Tether’s claims that the USDT stablecoin was fully backed the US dollar.

Tether also signed an $18.5 settlement with the New York Attorney General (AG) over false claims of USDT’s backing.

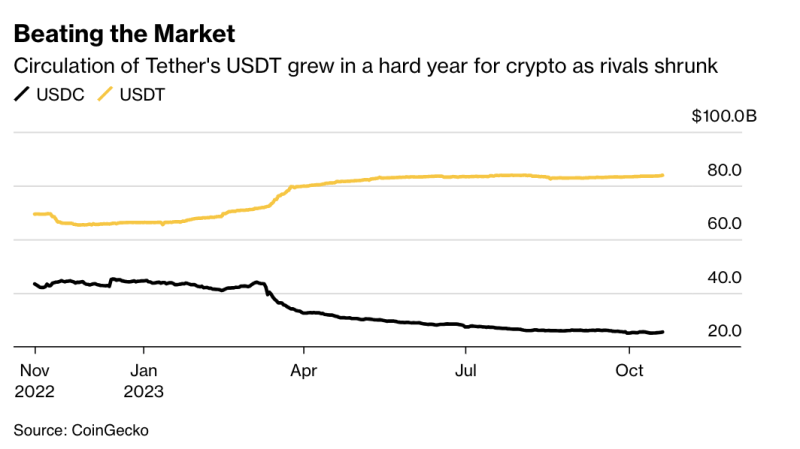

Despite various controversies, the circulation of USDT kept increasing throughout the bear market. While the circulation of the second largest stablecoin, USDC, decreased.

However, the move failed to placate some X (Twitter) users, with one, Juho Ojajärvi, writing:

“Yeah sure, but I bet it will just be a website showing some made up numbers instead of the audit that was promised YEARS ago.”

USDT’s circulation increased during the bear market. Source: CoinGecko/Bloomberg

Do you have anything to say about Tether reserves or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).