Skepticism surrounds Solana’s surge as FTX remains prudent with its holdings. SOL’s price drops amid bullish sentiment.

- Solana’s bull run gets questioned by skeptics.

- The price of SOL fell even though social sentiment remained high.

As the market took a positive turn over the last few days, Solana [SOL] managed to see a lot of growth. Solana was one of the strongest performers amongst various coins. About a month ago, SOL started a rally, and its price went up over 100% in under two months. Many started to question how long SOL’s rally would last.

Is your portfolio green? Check out the SOL Profit Calculator

FTX’s holdings

Several things played a role in this surge according to an analyst. In September, FTX, which had SOL in its holdings, was allowed by the court to start selling its assets.

$SOL Breakpoint Rally

The recent market rally has acted like a rising tide, lifting prices across the board for all tokens. $SOL however, had been gaining in strength weeks before the surge.

At the tail end of September, the token sparked its own rally, breaking away from the… pic.twitter.com/ET5URt7Bxi

— An Ape's Prologue (@apes_prologue) November 2, 2023

But even though the court gave the green light, FTX didn’t start selling right away. Some people thought they did, which led to a lot of traders trying to short SOL in anticipation of this big sell-off. But they were wrong.

As SOL’s price went up, those shorts were in trouble, and their positions helped push SOL’s price even higher. Then, on 24 October, FTX started moving its assets.

This was during a time when there was good liquidity in the market because of news that a Bitcoin ETF might get approved.

Some traders saw this as a chance to short SOL, and this added to the rising price. These shorts, along with strong trading volumes, were a risky combination.

In the end, it didn’t work out for them, and SOL’s price went to $46.80.

Even after all of this, FTX still has a lot of assets, including a fair amount of SOL that will be unlocked over the next few years.

FTX’s liquidators are careful with their selling, and they do it when it’s the right time. It’s also important to know that not all the assets might be sold on regular exchanges; some could be sold privately.

Social sentiment

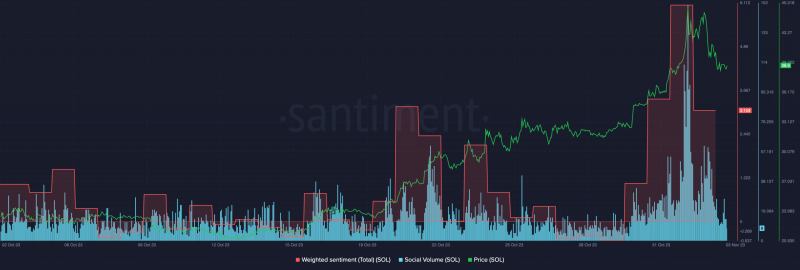

On the social front, Solana managed to do well. Over the last week, there was a large spike seen in terms of social volume.

Additionally, there was a surge in terms of sentiment around Solana. This showed that the number of positive comments around Solana was much higher than the negative ones.

Realistic or not, here’s MKR’s market cap in BTC terms

Despite these factors, SOL was trading at $38.90 at press time and its price fell by 11.89% over the last 24 hours. It is yet to be seen whether this will continue and hurt holders.