Lightning strikes Google Cloud as Apple closes the door on Bitcoin tipping — why a recent collaboration could bolster Bitcoin Lightning Network activity.

Google Cloud is the latest company to show interest in Bitcoin (BTC) Lightning. The $225-billion cloud and data service recently partnered with Voltage, an infrastructure provider specializing in the Bitcoin Lightning Network.

The partnership will allow one of the world’s largest cloud computing providers to roll out Bitcoin-based services worldwide while assisting the expansion of Voltage’s operations. Graham Krizek, CEO of Voltage, told Cointelegraph:

“Voltage is leveraging Google Cloud to go to service our customers more globally. So, we have larger customers that need nodes deployed in specific geographic regions like the U.K. or Asia.”

Conversely, Google can use “Voltage as sort of their outsourced Bitcoin and lightning team.” He said, “We service that business for them of actually, you know, helping companies that are interested in adding Bitcoin or Lightning into their services.”

The announcement received significant traction on social media and reflects Google’s growing understanding and acceptance of Bitcoin and Lightning. But crucially, the implications of the partnership run deeper.

Christopher Calicott, managing director of venture capital firm Tramwell Partners, told Cointelegraph, “We had some people that were former Googlers in backchannels […] saying this is the kind of unexpected [social media] engagement that definitely gets people’s attention at Google.”

Moreover, Google’s open-minded approach to Lightning diametrically opposes that of its competitor, Apple. Apple delisted Damus, the Lightning-friendly decentralized social media protocol, from the App Store recently, demonstrating an aversion to Lightning. Calicott explained that the tech world could be warming up to Lightning:

“There is a growing and broad-based corporate tinkering with Lightning in particular right now. If they’re adjacent to payments, they would ignore Lightning at their peril.”

Google Cloud operates under the umbrella of its parent company, Alphabet. The payments platform Google Pay boasts hundreds of millions of users in more than 15 countries.

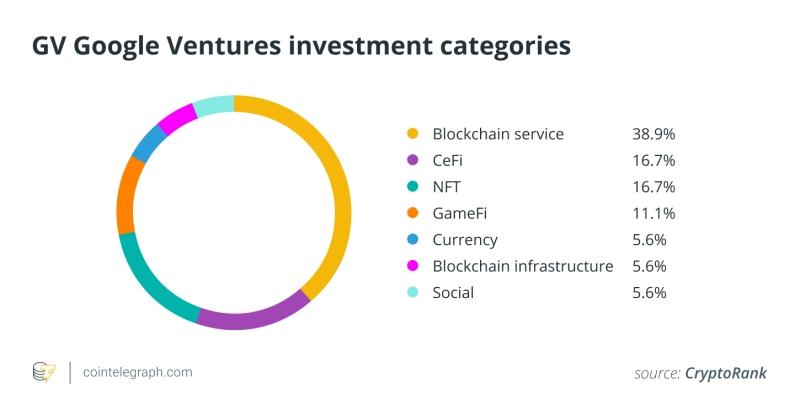

Since 2020, the investment arm of Google, Google Ventures (GV), has shown a robust interest in blockchain and Web3 companies, as well as Bitcoin.

GV participated in a $6-million seed round for Voltage in 2021. For Calicott, the interest of such a big player in the crypto space could be a sign of growing momentum:

“I hate to over-index on any one particular corporation here, but just for me, like anything in life, when people put their money where their mouth is, it sends a very strong signal of where they’re focusing.”

Krizek agreed, “I think that this really is a big signal into enabling more Bitcoin-focused strategies amongst Google specifically, but also just larger organizations.”

Despite Apple striking off the Lightning-friendly app Damus — much to the chagrin of the former Twitter CEO Jack Dorsey — Lightning continues to gain traction among billion-dollar businesses worldwide. One of Mexico’s largest companies has begun experimenting with Lightning, while two major crypto exchanges, Binance and Coinbase, recently promised Lightning integrations.

Nonetheless, it’s still early, and “we’ve got to observe this as it as it grows,” Calicott noted. Krizek, who’s seen his fair share of Bitcoin ups and downs, having participated in the Bitcoin space since 2012, underscored why the partnership is important:

“As we start to expose these organizations more so into Bitcoin and what is possible with it via Lightning, I think we’ve caught their attention already with the amount of interest and demand that we’ve had from this.”

He added that more services should be rolled out in the near future, complemented by efforts in Bitcoin education.