Bitcoin Price Prediction: The BTC Price recovery is encountering strong resistance around the $30,000 mark, as evidenced by short-body candles and higher wicks in the daily time frame. Within a week, the buyers witnessed several failed attempts to breach the psychological level, indicating the overhead supply was aggressive. As the sellers continue to defend this coin is poised for a minor pullback before making the next leap.

Also Read: Bitcoin (BTC) Price Forms Support as $30K as Dominance Returns to Multi-Year High

Will BTC Price Recovery Hit $32000?

- The $30000 level stands as the crucial resistance level of coinholders

- A potential pullback in ETH price could recuperate the bullish momentum and attract more buyers to the market

- The intraday trading volume in Bitcoin is $12 Billion, indicating a 17% gain.

Source-Tradingview

The Bitcoin price recovery picked up momentum after giving a decisive breakout from the downsloping monthly resistance on October 16th. The post-breakout rally pushed the coin price from $28,000 to the current trading price of $30,000, registering a 6.5% jump.

However, the recovery trend has witnessed a major roadblock around $30,000 evidenced by a higher price rejection candle in the daily chart. This overhead supply pressure could trigger a minor pullback and push the BTC price to the previously breached resistance of $28600.

Interestingly, the BTC price had witnessed two similar pullbacks recently, and it never plunged below the 61.8% Fibonacci retracement level.

Thus, for the anticipated pullback, the $28,633 and $27,000 stand as crucial support that could bolster buyers for higher recovery. The post-correction rally would likely surpass the $30000 mark and hit a July 13th high of $32000.

1 BTC to USD = $30638.889 2.03% (24h) Buy / Sell

Buy Crypto on an easy to use platform

Invest in leading cryptocurrencies such as Bitcoin, Ethereum, Cardano and more…

BTC

USD

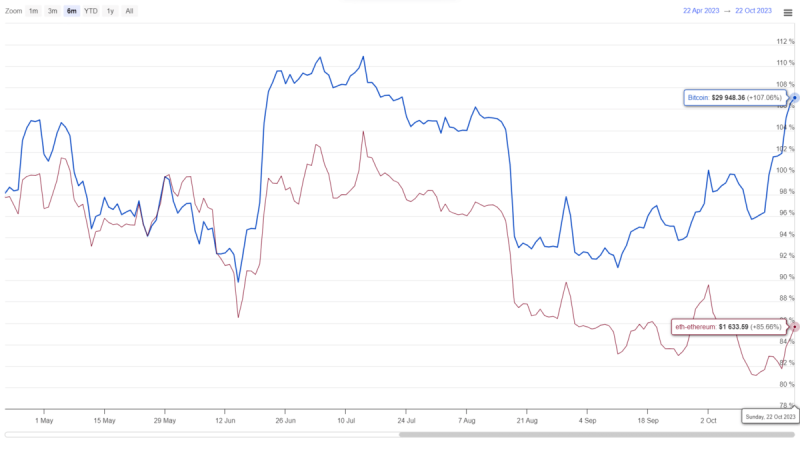

BTC vs ETH Performance

Source: Coingape| Bitcoin Vs Ethereum Price

In a comparative analysis spanning the last six months, Bitcoin and Ethereum have displayed different price behaviors. While the Ethereum price has been in a correction phase characterized by lower highs and lower lows, the BTC price has managed to maintain a more stable, sideways trajectory which suggests a better position for a recovery trend.

- Bollinger Band: An uptick in the upper boundary of the Bollinger Band indicator reflects the bullish momentum is active.

- Vortex Indicator A bullish alignment between the VI+(blue_ and VI-(pink) slope reflects the current recovery trend is intact.