This unexpected downturn has resulted in severe liquidations for traders, who have mostly been bullish on price action.

- The drop in Bitcoin’s price propelled the wipeout of leveraged positions worth over $900 million.

- Implied volatility doubled, but market participants saw a buying opportunity.

The cryptocurrency market witnessed a tumultuous turn of events as leading digital asset Bitcoin [BTC] faced a sharp decline. This was followed by BTC’s value decreasing to a concerning $26,000, marking a significant retreat from its previous highs.

BTC’s fall leaves traders in ruins

The unexpected downturn has resulted in severe liquidations for traders, who have mostly been bullish on price action in recent times. According to Coinglass, the capitulation ensured that over $900 million in leveraged positions were liquidated in the last 24 hours.

When traders engage in trading on cryptocurrency derivative exchanges, they are constantly exposed to additional risks. So, when the liquidation price of a trader’s position is triggered, their position is forcibly closed by the exchange’s risk engine.

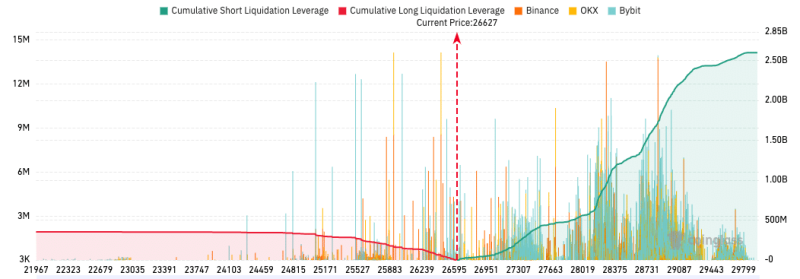

And from the liquidation heat map, thousands of positions, especially longs, have been wiped out across several exchanges.

An undeniable reason BTC has fallen to low levels is the increase in large sell-offs by investors. For instance, amid the chaos, Coinglass revealed that a whale sent 2,645 BTC to a Coinbase wallet. Another transferred 727 BTC to a BitStamp wallet. And there were many more like that.

Typically, actions like these suggest an intent to sell, and a spike in exchange inflow. Therefore, it was unavoidable not to see the BTC price plunge when it did. In addition to whales’ action, AMBCrypto reported bearish tendencies lately, which may have also contributed to the price plunge.

Sell pressure and a volatility change

According to CryptoQuant, demand for BTC in the U.S. decreased. The on-chain market analytics provider has used the Coinbase premium being negative as a reason for its opinion.

For context, the Coinbase Premium Index measures the gap between BTC prices on Coinbase and Binance. A positive reading of the Coinbase Premium Index indicates strong buying pressure on the spot market.

But since the metric decreased, it means institutional demand has been low, and selling pressure had dominated the Over-The-Counter (OTC) market.

2/ US Demand

The sell off was preceded by a period of low #bitcoin demand in the US (negative Coinbase premium). pic.twitter.com/jfsOtLxWWD

— CryptoQuant.com (@cryptoquant_com) August 18, 2023

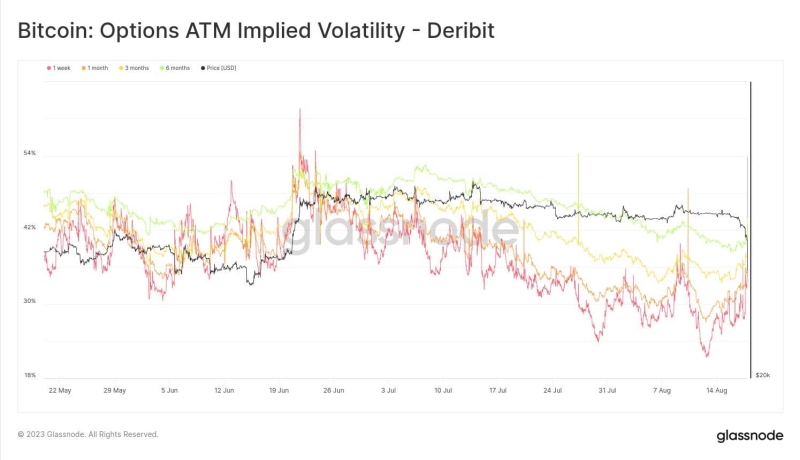

Furthermore, Glassnode’s data showed that the incident affected the Options’ Implied Volatility (OIV). Often used to price options contracts, the OIV uses supply and demand to determine market strength and possible traders’ action.

When the OIV is 20, it is considered extremely low. Here, traders may find buying opportunities. But at 80 and above, the OIV is considered extremely high. Therefore, traders may be looking for selling opportunities at this point.

According to Glassnode, the OIV jumped from 24% to 55% suddenly. A case like this could be a signal for traders to sell, as BTC has the potential to become really unstable.

Buy the dip?

On the other end, it seems that the broader market considers the price plunge as an opportunity to purchase at discount prices. According to Santiment’s social tool, the “buy the dip” phrase has been popular in search and discussions over the last 24 hours.

One reason why this has been trending could be linked to the BTC technical state. At press time, amid increasing volatility, the Relative Strength Index (RSI) tapped 7.01 on the four-hour chart.

For many, such an oversold level presents a buying opportunity. But in some corners, BTC could drop to $25,000 once more before a perfect opportunity presents itself. At press time, the coin exchanged hands at $26,362— a 7.94% decrease in the last 24 hours.