10 Years of Decentralizing the Future

May 29-31, 2024 – Austin, TexasThe biggest and most established global hub for everything crypto, blockchain and Web3.Register Now

NEW YORK – Sam Bankman-Fried’s criminal fraud trial is entering the home stretch, with federal judge Lewis Kaplan set to explain to jurors how the law applies to the seven charges against the FTX founder.

Both the Department of Justice and the defense team rested their respective cases on Tuesday after the one-time crypto exchange heavyweight completed his testimony. If convicted on all counts, Bankman-Fried could spend decades in prison (and theoretically up to 115 years).

His trial, which kicked off at the beginning of October, now moves into a new phase, one more focused on the jury specifically rather than the evidence.

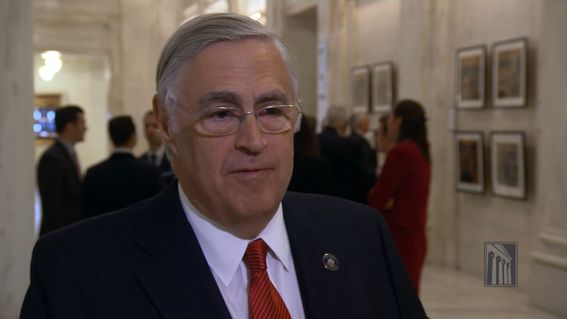

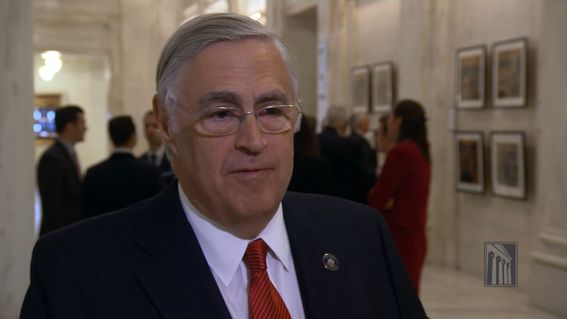

This began Tuesday afternoon, when the parties discussed the proposed jury instructions drafted by the judge. While Judge Kaplan didn’t quite lose his patience immediately, he soon found himself asking the various attorneys to explain their arguments clearly and quickly.

Early on, the question of what laws govern FTX’s terms of service – and the instructions surrounding these terms – came up.

“In our view, the legal terms are significant,” defense attorney S. Gale Dick told the court.

As usual, Judge Kaplan sounded unimpressed by the defense argument, which Bankman-Fried’s team had made before (including late Monday night). In short, the defense team has tried to argue that the terms of service are governed by English law, and therefore the jury should be instructed on it.

“I apply the law of New York,” the judge said.

Tuesday’s charge conference sometimes saw the lawyers debate just one or two words in a sentence of the 60-something page document, arguing those words would change the meaning of the charge presented.

The prosecution got an early win when the judge ruled that he would instruct the jury that they should find Bankman-Fried guilty of one count of wire fraud if they find there was either misrepresentation or misappropriation in how he marketed FTX to customers.

On another part, a “conscious-avoidance charge,” Assistant U.S. Attorney Thane Rehn argued that Bankman-Fried tried to avoid direct knowledge of some of the problems at FTX and its sibling company Alameda Research, pointing to the defendant’s testimony from earlier in the day.

Rehn’s colleague, AUSA Danielle Sassoon, had asked Bankman-Fried repeatedly if he had asked any questions of his lieutenants after learning about an $8 billion hole in Alameda’s balance sheet.

Closing arguments will kick off Wednesday with the DOJ and defense each estimating they’ll need two to three hours to present their competing narratives, and the DOJ maybe needing another 45 minutes for a rebuttal.

The judge estimated he’ll need some time to read the entire charge instructions to the jurors but deliberations could begin as soon as Thursday.

Edited by Marc Hochstein.